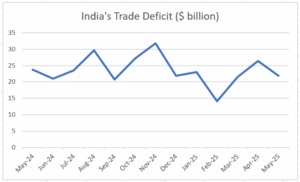

India’s merchandise trade deficit narrowed sharply in May 2025 to $21.88 billion, down from $26.42 billion in April, offering a temporary relief amid persistent global uncertainty. This improvement was largely due to a decline in both exports and imports—exports contracted by 2.17% to $38.73 billion, while imports fell 1.6% to $60.61 billion.

The contraction was driven by reduced inbound shipments of petroleum, coal, and gold. At the same time, non-petroleum, non-gems and jewellery exports, often viewed as a reliable indicator of core export strength, registered a healthy 6.9% growth to $30.71 billion. Notable contributors included electronic goods (up 54.1%), organic and inorganic chemicals (16%), pharmaceuticals (7.4%), and readymade garments (11.35%).

READ I India needs to generate more jobs in north and east

Services cushion holds strong

India’s services sector continued to act as a vital shock absorber for trade deficit. Services exports rose 9.3% to $32.39 billion, while imports inched up by just 1.7% to $17 billion. The resulting $15.25 billion surplus in services trade significantly softened the blow from the merchandise trade deficit.

This services surplus helped limit the current account deficit (CAD) for the first quarter of FY26 to an estimated $13 billion. If global crude prices remain stable—around $75 per barrel—the CAD is expected to stay within a manageable 1.2% to 1.3% of GDP, according to Aditi Nayar, Chief Economist and Head of Research at ICRA.

Crude shadow over trade deficit

However, geopolitical tremors in the Middle East threaten to upend this balance. The rising conflict between Iran and Israel has already jolted global oil markets. Brent crude surged 7% in a single day, followed by a 13% spike the following Monday—marking one of the steepest increases since the start of the Ukraine war. In India, crude oil futures settled at ₹6,119 per barrel.

With India importing nearly 80% of its oil needs, such volatility poses a serious risk. Analysts caution that in a worst-case scenario—particularly if the Strait of Hormuz, through which 17 million barrels of oil pass daily, is disrupted—prices could skyrocket to $150 per barrel. A surge of that scale would inflate India’s import bill and likely reverse the recent gains in narrowing the trade deficit.

Trade-off between inflation and growth

The implications are twofold. First, energy-intensive sectors like cement, steel, fertilisers, and petrochemicals will face steeper input costs. Second, SMEs, which lack pricing power, will bear the brunt of the shock. A similar scenario played out in 2022, when crude briefly hit $139 per barrel during the Russia-Ukraine conflict, triggering a spike in inflation and widening the CAD.

Policymakers will now have to walk a tightrope. Elevated oil prices may prompt the government to revise its fiscal assumptions, especially around fuel subsidies and welfare spending. At the same time, the Reserve Bank of India (RBI) could come under pressure to raise interest rates to curb inflation—risking a slowdown in growth just as the recovery begins to firm up.

Export resilience faces test

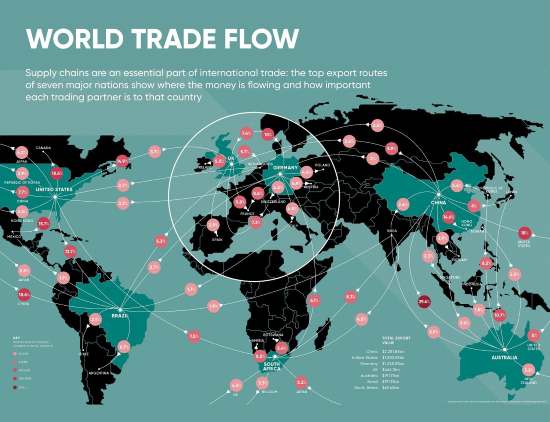

Despite these risks, India’s export sector has displayed commendable resilience. Exports to the United States rose by 16.9% in May to $8.83 billion, aided by front-loading of shipments ahead of the 90-day pause on Washington’s reciprocal tariffs. Yet, this momentum could falter if high oil prices escalate freight costs or disrupt shipping routes—especially in West Asia, where tensions are already testing the resilience of India’s supply chains.

Commerce Secretary Sunil Barthwal pointed to India’s “strong trade performance” despite the global headwinds, while FIEO President S C Ralhan praised the adaptability of exporters in navigating logistical hurdles and softening demand. But both acknowledged the uncertainty that lies ahead.

The narrowing of India’s trade deficit in May is a welcome sign—but it rests on fragile ground. The country’s dependence on imported oil remains its structural vulnerability. Any escalation in global tensions, particularly in the Middle East, could swiftly undo recent progress, with serious implications for inflation, fiscal health, and the rupee.

Unless India significantly diversifies its energy sources or builds stronger buffers against commodity shocks, its trade balance will remain vulnerable to external tremors. The gains of May 2025, though notable, must be seen as a pause in pressure, not an end to risk.