India and the US-China tariff deal: The much-hyped trade war windfall for Indian exporters appears to be evaporating as Washington and Beijing negotiate a tariff thaw, casting uncertainty on India’s role in global supply chains. Just weeks ago, Indian exporters were buoyant. A bruising tariff war between the United States and China had upended global trade flows, fuelling hopes that India could capture a sizeable slice of Beijing’s export share. That optimism now seems premature.

In a surprise development over the weekend, the US and China agreed to substantially ease their steep trade tariffs. The truce, reached in Geneva, rolls back US duties on Chinese imports from a punitive 145% to 30%, while China slashes its tariffs on US goods from 125% to 10%. Though the agreement is provisional—valid for 90 days—it threatens to undo the supply chain shifts India had been counting on.

READ I Tesla will struggle to crack India’s price-conscious EV market

A narrowing window

The India opportunity was real. Sectors such as chemicals, textiles, pharmaceuticals, engineering goods, and electronics stood to benefit from China’s tariff-induced retreat from the US market.

In 2024, the US imported $165.5 billion worth of chemicals, including APIs (active pharmaceutical ingredients). China commanded a 10% share of that, dominating APIs, vitamin C, and reagents with a staggering 71.8% of imports. India, with a cost-effective manufacturing ecosystem, was well-positioned to fill the gap.

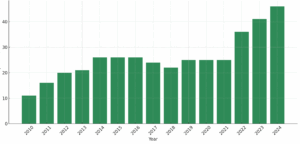

India’s trade surplus with the US (in $ billion)

The textile sector offered another promising prospect. US imports in this category stood at $16.6 billion, with China contributing 15.3%. India—strong in spinning, weaving, and garments—was ready to step in, bolstered by Make in India and PLI incentives.

But the US-China tariff deal shifts the calculus with the tariff advantage over China disappearing. The electronics sector, too, risks disappointment. The US will be a tough negotiator and India cannot expect any favourable treatment on import duties.

The China+1 strategy at risk

India was a key contender in the “China+1” strategy, where global firms sought to reduce dependence on China by diversifying supply chains. But with US-China trade ties warming, that strategy may quietly unravel.

Ajay Srivastava of the Global Trade Research Initiative says India may not be able to develop deep manufacturing—critical to building an industrial ecosystem. Chinese firms which were planning production in India may no longer show interest.

Indian firms had received a flurry of inquiries from American buyers post-April, particularly in textiles, apparel, hand tools, and home goods. There was even talk of Chinese firms rerouting shipments via India to avoid tariffs—a strategy that Indian authorities have pushed back on to ensure compliance with origin rules.

India and the US-China tariff deal

While the US-China tariff deal undercuts some of India’s export momentum, analysts caution that all is not lost. India still retains a 20% tariff advantage in certain categories—for now. The current US tariff on Indian goods stands at 10%, compared with 30% for Chinese imports.

This gap could help India in strategic sectors. The 20% margin incentivises shifting medical device manufacturing to India. The Apparel Export Promotion Council believes that if India secures a preferential tariff—potentially zero—it would re-establish competitive edge in garments and home textiles.

Moreover, India is currently negotiating a bilateral trade agreement with the US. A successful deal could lock in India’s 10% duty advantage and prevent the hike to 26% proposed under Trump’s new country-specific tariff framework. A beneficial trade pact is key to India’s export prospects.

Despite the opportunities, India’s export ambitions face systemic roadblocks. Its industrial scale remains no match for China’s. According to a NITI Aayog report, India has seen mixed results in attracting firms under the China+1 narrative, with Vietnam, Thailand, and Cambodia faring better due to lower costs, simpler regulations, and active FTAs.

Even marquee gains like Apple’s $12.8 billion in iPhone exports from India—most of it from Tamil Nadu—cannot mask the broader structural issues. Labour availability, infrastructure bottlenecks, and a lack of skilled workers in labour-intensive sectors remain persistent challenges.

A narrowing path ahead

The temporary nature of the Geneva accord leaves the future uncertain. Lower tariffs will boost US-China trade in electronics, machinery, and chemicals—segments where Indian exporters have recently made inroads in markets like Africa and Latin America. The deal has restored China’s advantage.

Still, not all sectors are equally exposed. India can pivot to niches less affected by the tariff war, such as organic chemicals, engineering goods, gems and jewellery, and IT-enabled services. India needs to engage with the United States for preferential access that will reduce uncertainty.

India must now accept that the US-China tariff deal is both a setback and a signal. A setback because the low-hanging fruit of redirected trade may no longer fall India’s way. But a signal too—one that underscores the urgency of scaling up manufacturing, reforming trade facilitation, and securing bilateral deals that offer long-term stability.

The dream of becoming the next big global manufacturing hub was never going to be easy. With the ground shifting beneath its feet, India must move quickly, strategically, and decisively—lest it find itself watching the global supply chain realignment from the sidelines.