India’s trade strategy at a crossroads: The time for equivocation is over. As the world’s fastest-growing major economy, India stands at a strategic nexus where trade policy, geopolitical autonomy, and national ambition intersect. Faced with escalating pressure from the United States and a conditional rapprochement with China, India must assert its independence — not by choosing sides, but by crafting its own strategic path. In this evolving landscape, India’s trade strategy and foreign policy are no longer parallel tracks; they are increasingly one and the same.

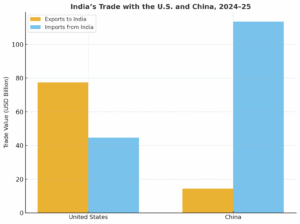

India’s external economic and strategic environment has undergone marked change. On one front, the US has ramped up trade leverage against India. For example, in August 2025, the US imposed an additional 25 per cent tariff on Indian goods in response to India’s continued imports of Russian oil, bringing the cumulative duty to 50 per cent — a level unprecedented in US – India trade relations. On the other front, India remains heavily dependent on Chinese imports — in 2024-25 India’s bilateral trade deficit with China reached $99.2 billion, with exports at $14.3 billion and imports $113.5 billion.

These twin pressures mirror a more fundamental strategic tension: India’s ascent as a major economic power meets stiff structural dependencies and external levers. The result: New Delhi cannot afford to be passively buffeted between Washington and Beijing. It must chart a course that safeguards its economic interests, reinforces its strategic autonomy and ensures that trade policy advances rather than undermines national goals.

READ I Will India’s financial sector reforms win back investors?

From liberalisation to leverage: India’s economic context

India’s trajectory since 1991 has integrated it deeply into global trade, outsourcing, and manufacturing networks. But that integration came with new dependencies: Chinese components and goods flooded Indian markets; US demand underpinned India’s service-export boom. Yet today the dependencies look different — and riskier.

In the China relationship, India’s import dominance is clear. Despite policy efforts such as the “Make in India” initiative and Production Linked Incentive (PLI) schemes, India’s export capacity remains weak in high-value manufacturing and sources of technological inputs. A recent structural study found that India’s limited R&D investment, poor logistics and skill gaps continue to inhibit a substantive reduction in trade imbalance vis-à-vis China. On the US side, Washington’s use of trade measures to enforce broader strategic agendas — agriculture access, energy policy, tariff structures — has exposed India’s vulnerability as “partner, supplier and captive” simultaneously.

Thus, the familiar narrative of “growth through globalising integration” must now be supplemented by “growth through strategic independence”. India cannot simply ride the global trade wave — it must steer it.

Contradictions and neglected dimensions

Two contradictions merit emphasis. First, while India pursues dependency reduction from China in strategic sectors, its trade deficit is ballooning. As one analysis puts it: India’s exports to China fell by 14.5 per cent in March 2025 alone, while imports surged by over 25 per cent in the same month. If India is serious about reducing dependence, then unchecked import growth from China in critical sectors is a worrying sign.

Second, while India looks to deepen ties with the US (and enjoys advantages in certain sectors from US tariff gaps) — for instance, the NITI Aayog has noted that India could gain from high US tariffs on competitors like China — the US is simultaneously employing trade leverage that puts Indian exporters at risk. In short: A closer US tie is desirable — but only if it is entered on India’s terms, not as Washington’s junior partner.

India’s strategic autonomy is deeply intertwined with trade diversification and supply-chain repositioning. If Indian firms remain tethered to a single major partner (China for components; US for services), India will have little bargaining room. The broader policy absorption is that India’s trade strategy is now foreign-policy infrastructure.

Comparative Insight: lessons from global peers

Two relevant global analogues provide insight. South Korea’s cautious balancing between the US and China illustrates the importance of maintaining flexibility while deepening regional value-chain autonomy. Meanwhile, Vietnam’s “China Plus One” strategy offers a strategic template: by attracting manufacturing redirection from China, the country gained leverage in both trade and geopolitics.

India, for example, has begun to benefit from this trend: in Q2 2025, smartphones assembled in India accounted for 44 per cent of US imports, up from 13 per cent a year earlier — largely as part of Apple’s “China Plus One” strategy. This demonstrates that supply-chain opportunity exists — but India must scale and institutionalise it across sectors, not treat it as isolated wins.

India’s trade strategy: Asserting independence

What then should India do to assert its independence, in a context where US trade pressure and China-dependency converge?

First, prioritise diversification in trade and supply chains. India must reduce strategic dependence on any single partner. This means accelerating domestic industrial ecosystems (mining, electronics, APIs), but also actively seeking alternate trade gateways (Southeast Asia, Africa, Latin America) so that neither Washington nor Beijing holds a veto over India’s external options.

Second, condition engagement with the US and China on India’s terms. With the US, India must resist being compelled into market openings (agriculture, dairy) that undermine domestic interests, as Washington’s recent approach has demonstrated. With China, India must recognise that structural dependency often translates into strategic vulnerability — and thus design targeted interventions (safeguards, value-chain substitution) rather than passive imports.

Third, knit trade and foreign policy into a coherent strategic framework. Trade deals must not be purely commercial; they must embed resilience, sovereignty and diversification. India should craft a dedicated industrial-diplomatic architecture that aligns trade strategy with broader power-anchor goals: supply-chain security, technological independence, regional integration.

Finally, reinforce institutional capacity: investment in logistics, R&D, skills, innovation ecosystems. The structural study on India–China trade imbalance emphasised that without these, industrial policy gains could stall. India must not rely on external partners for its industrial uplift; it must build from within, with open trade as enabler rather than master.

India’s trade strategy and strategic independence

India’s trade strategy in the coming months will shape not just trade flows, but its standing as an independent actor in a multipolar world. On one side is the US, seeking India as a strategic bulwark and trade partner — yet also willing to deploy tariffs, insist on concessions, and centre itself in the partnership. On the other is China, a dominant supply-chain force and trade partner — yet one whose contemporary rise embodies structural dependencies and geopolitical risk. India cannot afford to be either America’s junior partner or China’s dependent customer.

Assertive independence does not mean isolation. It means engagement — diversified, strategic, autonomous. India’s trade strategy must align with strategic autonomy, so that when Washington presses or Beijing lures, New Delhi retains both options and agency. The alternative is subordination—where trade becomes a lever held by others, not a tool controlled by India.

In short, India’s ascent depends not only on growth-rates, reform trajectories or global deals — it hinges on whether India shapes the rules of its own trade and foreign policy or simply lives under them. The time to assert that independence is now.

Kumar Kuntikanamata is Councillor in Fleet Town council, Hampshire, UK. He is an expert in pharma industry and worked for many global firms. He has also worked as Vice Chairman for British South India Council of Commerce.