Tariffs, bond yields, and the global impact: The recent months have witnessed heightened trade tensions, unsettling financial markets that had only just begun to regain composure. President Donald Trump’s latest salvo—a proposed 50% tariff on European Union goods and a 25% levy on smartphones unless companies like Apple and Samsung shift production to the US—has shaken investor confidence and sent ripples across asset classes.

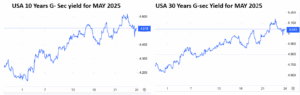

The bond market has reacted sharply. US 10-year Treasury yields have climbed above 4.6%, while 30-year yields have breached 5.1%—their highest levels since November 2023. This sudden surge in yields carries far-reaching consequences not just for the US economy, but for global financial stability.

READ I India’s ethanol blending push faces US trade pressure

The bond yield spiral and policy dilemma

Rising bond yields make borrowing costlier for governments, directly increasing interest expenses on newly issued debt. For Washington, this means a ballooning fiscal deficit and added pressure on an already substantial national debt. In response, governments often resort to monetary easing or stimulus packages—tools meant to invigorate demand, but which can easily stoke inflation in a high-debt environment.

This sets off a vicious cycle. Higher inflation compels central banks to raise interest rates to keep prices in check, which in turn pushes bond yields even higher. The result is a self-reinforcing loop: rising yields drive up debt costs, which prompt expansionary policies, only to fuel inflation further. Policymakers are left walking a tightrope, where each measure risks amplifying rather than resolving the crisis.

Equities under pressure

The surge in yields has also rattled equity markets. Over the past week, the Dow Jones Industrial Average fell 0.6%, the S&P 500 slipped 0.7%, and the Nasdaq Composite dropped by around 1%. As fixed-income investments become more attractive, the relative appeal of equities—particularly growth and tech stocks—diminishes.

Tech stocks, whose valuations rely heavily on projected future earnings, are especially vulnerable. Higher yields raise the discount rate applied to those earnings, leading to steeper valuation cuts. This has triggered a wave of portfolio rebalancing, with investors rotating out of equities and into safer debt instruments. The sell-off underscores how sensitive the modern equity market remains to shifts in interest rates.

Fiscal space shrinks

Higher borrowing costs have another, often overlooked, consequence: they constrain public investment. As interest payments consume a larger share of government budgets, spending on infrastructure, healthcare, education, and social welfare inevitably takes a hit. Economists call this crowding out—where essential public investment is sacrificed to meet rising debt obligations.

Persistently elevated yields can deepen this fiscal bind. Should governments continue to borrow to support flagging growth or plug widening deficits, the debt burden only grows heavier. This, in turn, erodes investor confidence, potentially inviting credit rating downgrades and increasing risk premiums. On May 16, 2025, Moody’s downgraded the US sovereign credit rating from Aaa to Aa1—underscoring these mounting concerns.

In the long run, rising debt and shrinking fiscal headroom may force policymakers to consider austerity measures or tax hikes—both of which could suppress economic growth and hurt consumer sentiment. The bond market’s current turbulence, then, is more than a financial flashpoint; it is a warning sign of structural imbalances.

Short-term capital flows into US bonds—lured by higher yields—have also strengthened the dollar. While a stronger greenback helps dampen imported inflation, it makes American exports more expensive abroad. That, in turn, could widen the U.S. trade deficit and hurt manufacturing competitiveness—ironically undercutting the goals of protectionist tariffs.

Emerging economies under strain

The fallout extends well beyond American shores. Rising US bond yields are squeezing emerging markets, particularly India. The yield spread between India’s benchmark 10-year bond and its US counterpart has narrowed to around 173 basis points—the tightest in nearly two decades. In 2004, the spread was last this narrow.

This shrinking differential reduces the appeal of Indian bonds to foreign investors, increasing the risk of capital flight. If outflows accelerate, the rupee could come under renewed pressure, leading to depreciation. A weaker rupee, in turn, raises the cost of essential imports such as crude oil and fertilisers, stoking inflation and widening the current account deficit. It also makes servicing external debt more expensive, straining corporate and sovereign balance sheets.

Currency depreciation can also rattle equity markets, triggering a loss in investor confidence. Rising input costs and tighter financial conditions could squeeze businesses and erode consumer purchasing power—stalling India’s growth engine at a precarious time.

Yield spread as early warning

The narrowing yield spread is more than a technical metric; it is an early warning indicator. It suggests that capital is being reallocated from emerging to developed markets—a dynamic that could prove destabilising for countries like India, where growth capital is still critically needed.

In sum, the recent surge in US bond yields—triggered in part by aggressive tariff posturing—has unleashed a chain reaction with global consequences. From swelling deficits and equity market corrections in the US, to currency stress and capital outflows in India, the implications are sobering. Policymakers would do well to read the bond market not as a sideshow, but as the main stage of today’s economic drama.

Dr Pravin Jadhav is Associate Professor and Head, Department of Humanities and Social Sciences,

Institute of Infrastructure Technology Research and Management, Ahmedabad.