The growth of financial services has been phenomenal due to the development of technology. A number of fintech players in India emerged from nowhere to grab the opportunities presented by the digitisation of the economy and managed to become major players in the financial system.

Fintech players amalgamate technology with innovative business models that are interconnected with banks. The fintech ecosystem received a major boost from the blockchain technology, which works as a centralized distributed ledger mechanism, eradicating the threat of data theft and retrieving the information as and when needed. When it comes to the banking and financial services industry, fintech ensures last-mile connectivity to the end-user.

READ I Fintech regulation: India seeks to balance innovation with risk management

Fintech companies use technology to improve or disrupt traditional financial services. These companies are typically startups and are focused on using technology to make financial services more efficient, accessible, and affordable.

There are also techfin players which refer to traditional technology companies such as Google and Amazon that have entered the financial services industry. They are leveraging their customer base to offer financial services. In India, both fintech and techfin have seen significant growth in recent years. Some of the successful fintech players are Paytm, PhonePe, and Razorpay, which offer digital payments, peer-to-peer lending, and other financial services.

Fintech disruption in India

Fintech has been widely adopted in BFSI. The origin of fintech in banking is linked to the automated teller machines (ATM), introduced in 1967, and the Society for Worldwide Interbank Financial Telecommunication (SWIFT), established in 1973. According to the Financial Stability Board (FSB), fintech is “a new financial industry that applies new technology to improve financial activities, including processes, products, or even business models.”

The recent developments in fintech could be linked to artificial intelligence, blockchain technology, cloud computing, and data science. The complete amalgamation of these four creates a comprehensive financial ecosystem for providing services. The areas that fintech broadly covers are (i) deposits, (ii) payments, (iii) clearing and settlements, (iv) insurance, and (v) investment management services. There are several questions around the fintech industry that need to be answered. Some of them are:

- Does fintech replace traditional financial intermediaries?

- Are fintech firms capable of gaining the trust of millions of customers?

- Would fintech players be efficient enough to resolve the risks associated with traditional businesses?

- Do fintech firms work like banks, or will they work as shadow banks?

- Will regulators recognize fintech firms under the regulatory umbrella?

Before answering these questions in a structured manner, let us go through the data and get some insights into the newly emerged domain. According to Statista (2019), there are more than 12,000 fintech firms providing services across the globe.

The fintech market in India is expected to grow at a 22.7% CAGR during 2022-2025. It has been studied that consumers’ choice of digital mode has increased by 15-20% just after four weeks of Covid-19. This signifies the depth and importance of the adoption of technology by consumers across the globe, whether it is the global financial crisis of 2008 or the Covid-19 pandemic, which triggers digital penetration in developed and developing economies.

The Indian digital ecosystem can be traced back to the Jan Dhan, Aadhaar, and Mobile trinity, which is considered the building block of the digital revolution in the Indian landscape. The digital platform is further strengthened by implementing financial inclusion and Direct Benefit Transfer (DBT). As time passed, the Jio revolution in the telecom space reached every doorstep and household, connecting the unconnected parts of the country. The fintech age is providing fingertip banking and non-banking opportunities as the foundation stone has already been strengthened.

The rise of financial technology has disrupted the traditional banking system, bringing a wave of digital innovation and transforming the way financial services are delivered to customers. While fintech has brought several benefits, including convenience, speed, and accessibility, there are concerns that it may replace the age-old traditional banking system. The debate over this issue continues in many forums in the finance fraternity, and many studies have been conducted to address these concerns.

Challenges for fintech industry

One of the primary factors that could pose a challenge to fintech entities is the trust and faith of millions of customers in a virtual space. Unlike commercial banks in India, fintech operates in a completely new environment for customers, and several risks associated with implementing and delivering financial services in a virtual space, such as operational risks, counterparty risks, business risks, and settlement risks, need to be addressed.

The absence of a regulated environment and clear grievance redressal mechanisms policy for fintech players further complicates the issue, posing a trade-off between commercial banks and fintech players in redesigning their business models to cater to seamless financial services to customers while adhering to the stiff competition in the market.

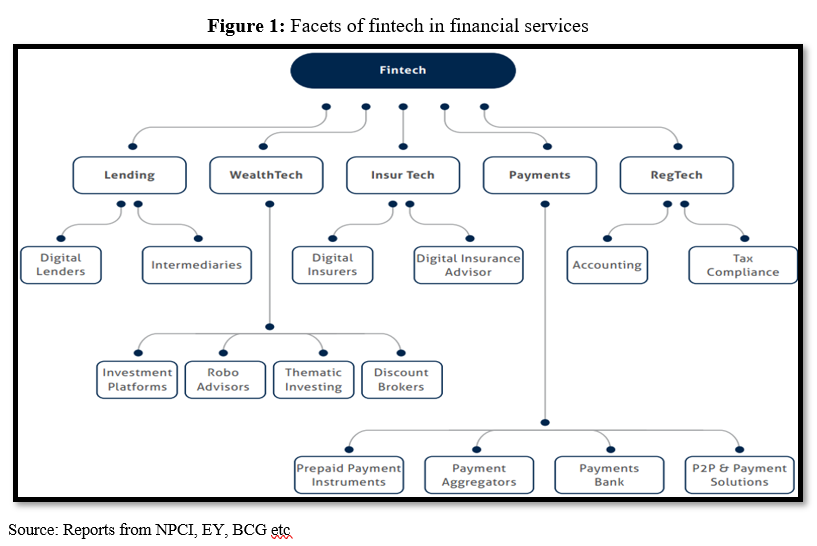

Fintech has expanded horizontally as well as vertically to several areas of the financial domain, including Insurtech, Agritech, Wealthtech, Regtech, Supertech, etc. However, most of these fintech players are neither registered nor regulated under the regulators of the respective countries, leading to regulatory arbitrage as a hindrance to the growth of the fintech players in the BFSI sector. It is crucial for sectoral regulators such as RBI, IRDA, and SEBI to come forward and provide stringent regulation for the shadow entities for a healthy financial environment by keeping the interests of millions of customers in mind.

Despite the challenges, fintech entities have enormous opportunities in an emerging economy like India, where millennials are quickly adopting digital platforms to pay their utilities and households. Fintech could provide a positive message to the new generation of fintech players to enter the market with new financial products to reach the unserved part of the country. With structured regulation and proper due diligence mechanisms in place, fintech would gain the faith and attention of the left-out population of the economy in the near future.

India is a bank-based economy, and people rely on government-backed commercial banks rather than virtual entities like neo-banks. However, to achieve the target of providing financial services to the unbanked, fintech is one of the alternatives in an emerging economy like India. Proper knowledge regarding the accessibility of technology, safety operations, and timely grievance redressal could gain the attention of the fintech platforms by millions of people in the coming days of the finance era.

(Shiba Prasad Mohanty is a research associate at the National Institute of Securities Markets, Navi Mumbai.)