The rupee crashed to an all-time low of 81 against the dollar on Friday. The currency has lost more than 8% against the dollar this year. India’s forex reserves stood at $545.7 billion on September 16, almost $100 billion less than the level a year ago, a standing testimony to the Reserve Bank of India’s unsuccessful efforts to defend the weak rupee and reduce volatility in the forex market.

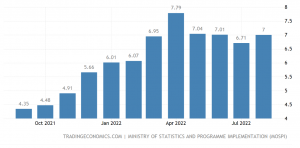

India’s retail inflation, measured in terms of consumer price index stood at 7% in August, up from 6.71% in July. The RBI’s six-member monetary policy committee is expected to raise the repo rate by 50 basis points when it meets next week. A half-percentage point increase will take the benchmark rate to 5.9%, 290 basis points higher compared to the rate in May. Economists expect the repo rate to reach 6.25% by the end of the year.

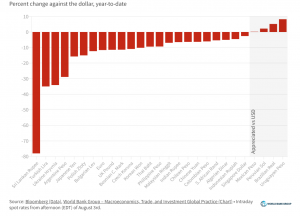

The rupee is following a global trend of major currencies depreciating against the dollar. The world economy was recovering from the pandemic crisis when Russia invaded Ukraine, triggering a huge geopolitical risk. The markets were ravaged, economic recovery slowed and inflation soared to historic levels. It is normal for the dollar to appreciate during economic crises as investors exit emerging markets and developed countries to invest in dollar assets that are considered comparatively safe. This leads to huge demand for dollars, leading to the appreciation of the currency.

READ I Indian economy crosses another milestone, but worries linger

Major currencies against the dollar

The dollar derives its strength also from the Federal Reserve’s resolve to tame inflation, even at the cost of a recession or stagflation. The annual US inflation rate is ruling at 8.3%, the highest level in more than four decades. The US central bank announced three back-to-back interest rate hikes of 75 basis points each, taking the benchmark lending rate to 3%-3.25% range.

Weak rupee and India’s global trade

The dollar is the most dominant currency in international transactions. So, a strong dollar will have an impact on their corporates that need the greenback to settle trade contracts. The strong dollar will make imports more expensive, affecting the investment by domestic companies and the government. However, a weak rupee is favourable for exports. Several export-led economies benefit from weak domestic currencies, but India is predominantly an importer. This means, a weak rupee will not help much, even in long term.

The main contributor to the rupee’s weakness is the strong demand for dollars from oil companies. India imports more than 80% of its energy requirements. Though India is negotiating with major oil exporters for rupee payments, it hasn’t made much headway yet.

India annual inflation rate

India’s thriving IT and pharma sectors could benefit from a weak rupee, leading to several commentators seeking the rupee to fall further to make India’s exports more competitive. But the recent depreciation of the rupee hasn’t helped India’s exports much as the other currencies have fallen more sharply. Among India’s competitors, China and Bangladesh saw their currencies depreciating more against the dollar. Adding to the worries, the euro and the British pound depreciated in double digits against the US currency, eroding the comparative advantage the rupee may have had on its exports to the EU, a large import destination for Indian goods and services.

In August, India’s imports saw a massive 37.28% increase to $61.90 billion, while its exports of goods rose by a meagre 1.62% to $33.92 billion. India’s trade deficit rose to $27.98 billion in August, a 138.88% increase from the same month last year. The country’s exports contracted also sequentially in July and August. India’s current account deficit also is expected to widen to 3% of the GDP in the current financial year ending March 2023.

Weak rupee and economic growth

The impact of a weak rupee on Indian exports is affected by slowing global demand which will, in turn, will impact India’s economic growth prospects this fiscal. As the Federal Reserve raises its benchmark interest rate, other central banks including the RBI will have to raise rates to defend their currencies. This involves a policy dilemma as the central banks will need to defend their currency foreign investment without stoking interest rates that will have a bearing on both consumer demand and corporate investments.

The current crisis saw investors exiting emerging markets for six months running, depriving the local economies of vital foreign capital as well as much-needed foreign exchange reserves. Fall in demand will slow the economy, affecting the government’s revenue collections.

As the dollar strengthens, several countries and their businesses will find it difficult to borrow both from domestic and international markets. Many developing countries may see domestic lenders unwilling to assume the risk because of currency volatility, forcing businesses to borrow from foreign institutions. The strong dollar will make these loans very expensive in terms of local currency and the repayment burden increases, bankrupting heavy borrowers. India’s dollar-denominated debt is relatively low and the country has ample forex reserves in its kitty. This means the threat on this count is not much for India.

Now what are the policy options for the Union government and the RBI? India may not have many options to address the appreciating rupee. The country needs to strengthen its fiscal position. There is wide agreement among economists that the central bank may have to allow the rupee to depreciate further in line with the global trend.

Anil Nair is Founder and Editor, Policy Circle.