India will see a 20% decline in foreign direct investment inflows in financial year 2021-22, after recording all-time high FDI inflows of $82 billion in the year ended March 2021. India also had a great 2020, especially the last six months of the calendar year, according to ‘Asian net inward FDI on track for a record year — what happens next?’, a UBS Global research report released last week.

Slowing FDI inflows could further weaken the rupee which was trading at 75.99 against the dollar on Saturday. While India may benefit from the reshoring of supply chains due to the pandemic, the inflows may not be robust enough to fully meet its current account deficit. The services sector continued to receive huge amounts of FDI, while manufacturing suffered during this period.

The spurt in FDI inflows in 2020-21 was mainly due to investment in Reliance Jio by FB, Google, Saudi PIF, and KKR. The monthly FDI inflows into India have been hovering around $2-5 billion, but it was more than $16 billion in August 2020. FDI from the US is around $4 billion in a year on an avewrage. It jumped to $13 billion.

READ I Cryptocurrency dilemma: What history teaches us about money, assets

FDI inflows to pick up after lull

The UBS report forecasts FDI inflows of $85 billion in FY26 and at least $100 billion in five years as India has the capacity to absorb large amounts of foreign funds. A Deloitte report says India continues to be an attractive market for foreign investments in both short- and long-term.

India has created a favourable policy regime for inward foreign investments. It has made relaxations in FDI norms in defence, oil refineries, telecom, power and stock exchanges. FDI is a large source of funds for the economic development of India. Low wages and investment sops such as tax exemptions make India an attractive destination for foreign direct investment. India has received more than $500 billion in FDI since financial year 2000-01.

FDI inflow of over $440 billion was recorded in the last seven financial years. This is around 58% percent of the inward flow of investment since 2000. Singapore, Mauritius, the US, the Netherlands and Japan are the largest source of FDI into India. Computer software and hardware sector is the largest recipient of FDI inflows.

READ I Semiconductor industry: India goes for broke to gain a toehold

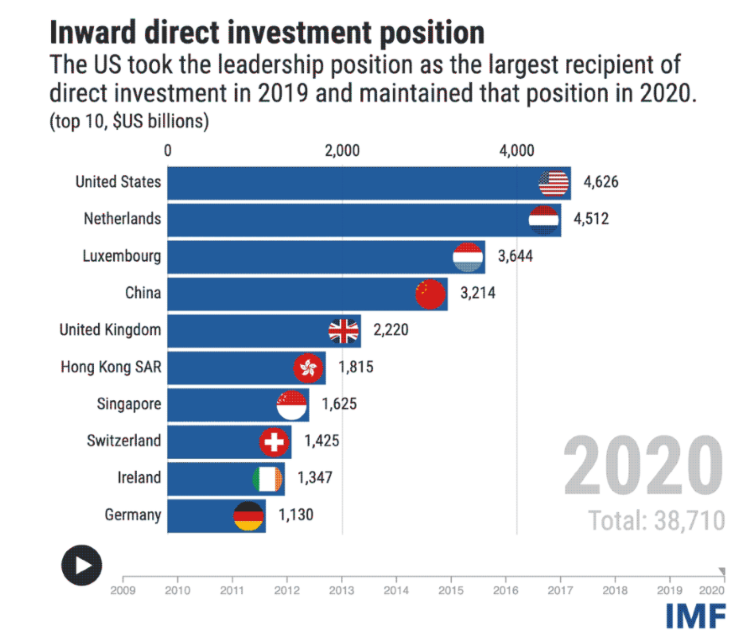

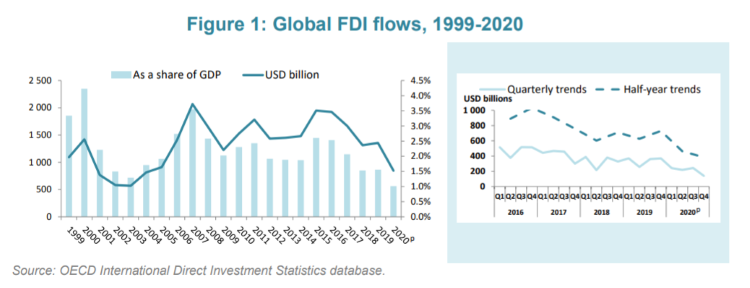

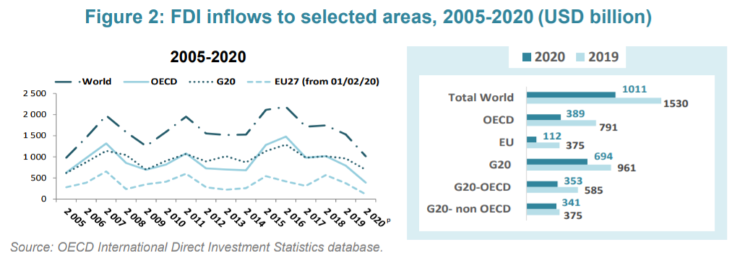

The United States, the Netherlands, Luxembourg, China, and the United Kingdom were the largest recipients of foreign direct investment in 2020. The year saw FDI inflows increase by $2.2 trillion (6%) from 2019, shows IMF’s Coordinated Direct Investment Survey. Hong Kong, Singapore, Switzerland, Ireland, and Germany complete the list of top 10 recipients of FDI in 2020. The growth in inward direct investment inflows was in line with the five-year trend despite the outbreak of the Covid-19 pandemic that disrupted businesses world over causing huge losses.

Most of the increase in global FDI inflows in 2020 was towards the United Kingdom, Germany and China. China recorded the largest increase in both FDI inflows and outward investment. The US consolidated its position as the largest FDI recipient with the help of higher inflows from Japan, Germany and the Netherlands. Tax havens like the Netherlands, Luxembourg, Hong Kong, Singapore and Ireland continued to top both inward and outward FDI charts.