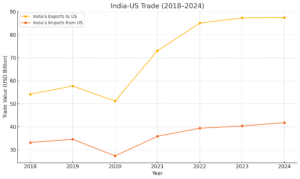

US tariffs raise stakes for Indian exporters: As global trade realigns under the weight of rising protectionism and shifting geopolitical alliances, the United States’ decision to impose a 27% reciprocal tariff on a wide range of Indian imports marked a turning point in bilateral trade relations. The move signals intensifying trade tensions, but its impact on India’s export economy is nuanced and varies considerably across sectors.

The new tariff regime represents a sharp departure from the historically low duties on Indian goods. Until now, Indian electronics entering the US faced an average tariff of just 0.41%, while gems and jewellery were taxed at a modest 2.12%. The sudden escalation to 27% poses a formidable challenge to Indian exporters, especially in price-sensitive and high-value segments. The measure is part of Washington’s broader strategy to correct trade imbalances through reciprocal tariff frameworks. Despite diplomatic efforts by New Delhi, the tariff hike has been applied across a broad industrial spectrum.

READ | India may offer cheaper natural gas to revive LNG trucks amid US pressure

Sectoral analysis: Gainers, losers, and survivors

Textiles and Apparel: India’s textile and apparel exports to the US touched nearly $10 billion in 2023-24. Despite the tariff hike, India may still retain a competitive edge. Rivals such as Vietnam, Bangladesh, and China face even steeper US tariffs—46%, 37%, and 34%, respectively. Additionally, the textile sector represents a relatively small share of India’s GDP (about 2%), unlike in Bangladesh (11%) or Vietnam (15%). This cushions the macroeconomic impact for India. With US importers likely to rebalance sourcing strategies away from higher-tariff countries, Indian textile exporters could capture additional market share despite cost pressures.

Electronics and components: India’s electronics exports to the US—valued at around $14 billion—are among the hardest hit by the 27% levy, up from near-zero levels. This risks derailing India’s ambition of becoming a global electronics manufacturing hub. Yet, there’s a crucial reprieve: semiconductors have been exempted from the new duties. Their exclusion underscores India’s growing strategic importance in global tech supply chains. Meanwhile, countries like China (up to 79% tariff on electronics) and Vietnam continue to face heavier penalties, offering India some relative competitiveness, particularly in niche segments.

Pharmaceuticals: India’s pharmaceutical exports, largely made up of affordable generics, account for nearly $9.8 billion—or 30% of India’s total pharma exports. These products have been spared from the tariff hike, a move that benefits both Indian manufacturers and the US healthcare system. Pharmaceuticals are among a few strategically significant sectors—alongside copper, lumber, semiconductors, and key minerals—exempted by executive order. Still, with growing American focus on import dependencies, the sector remains vulnerable to future policy shifts.

Agriculture: India’s agricultural exports to the US, including rice ($3.97 billion), pulses ($454 million), and vegetable oils ($266 million), are valued at approximately $5 billion. These products are now subject to the 27% duty. However, India may retain market share due to relatively lower tariff exposure compared to rivals such as Thailand and Vietnam. Seafood, in particular, is expected to weather the change due to inelastic demand and low substitution. While short-term volumes may dip, the long-term outlook remains steady—perhaps even promising—as India steps in to fill tariff-created gaps.

Gems and jewellery: With annual exports to the US exceeding $9 billion, India’s gems and jewellery industry faces acute vulnerability under the new regime. Jumping from a 2.12% tariff to 27%, this highly price-sensitive sector may see demand contraction, especially from mass-market buyers. Exporters could be forced to absorb costs or restructure operations. Without relief measures, job losses and declining production are realistic risks in this labour-intensive industry.

Automobiles and components: Automotive exports, accounting for 27% of India’s outbound shipments to the US (around $6.8 billion), are technically exempt from the 27% duty. However, they remain subject to a pre-existing 25% tariff under Section 232 of the US Trade Expansion Act. Components have neither been hit with new duties nor granted fresh exemptions. While they avoid further escalation, cost disadvantages persist due to stiff competition from domestic US firms and tariff-exempt countries.

From Adversity to Advantage

India’s effective tariff rate of 26-27% now places it in the upper-middle tier among America’s trading partners—just above Japan (24%) and South Korea (25%), and significantly below China (54%) and Vietnam (46%). Though this undermines India’s previous preferential access, it still leaves room to outmanoeuvre harsher-hit competitors. Developed economies such as the UK (10%) and Switzerland (34%) face lower tariffs, but their export portfolios rarely overlap with India’s, limiting direct competition.

The Indian government has described the tariff development as a “mixed bag, not a setback.” Officials remain engaged in high-level trade talks with the US aimed at moderating the tariff regime. Industry bodies such as FIEO (Federation of Indian Export Organisations) and ICEA (India Cellular and Electronics Association) have praised New Delhi’s efforts in safeguarding critical sectors like semiconductors.

Going forward, Indian exporters will need to adapt quickly—by reassessing supply chains, exploring new markets, and leveraging co-manufacturing opportunities in low-tariff jurisdictions. Policymakers must consider export incentives, streamlined logistics, and targeted fiscal support to ease sectoral pain.

The imposition of steep US tariffs on Indian exports underscores the fragile nature of global trade in an era dominated by protectionism and strategic rivalry. Yet, this disruption could become a defining moment for India. Sectors such as pharmaceuticals, semiconductors, and even textiles may emerge stronger, while others like electronics and jewellery face sharper trials. With agile policy responses and business resilience, India can turn this moment of pressure into a platform for long-term export growth and global manufacturing leadership.

Chirayu Sharma is independent researcher based in Pune. Jadhav Chakradhar works at Centre for Economic and Social Studies (CESS), Hyderabad. Pravin Jadhav works at Institute of Infrastructure, Technology, Research and Management (IITRAM), Ahmedabad.