Gold in India has always carried more than ornamental or investment value. It is a deeply embedded cultural and economic asset, long seen as a hedge against inflation and currency depreciation. But its significance is now being redefined. Global economic uncertainty, digital innovation, and changing reserve management strategies are reshaping gold price and market. As India enters a new phase in its economic engagement with the yellow metal, the conversation must shift from sentiment to strategy.

Rising geopolitical tensions—from the protracted war in Ukraine to instability in West Asia—have injected volatility into global markets, reinforcing gold’s status as a safe-haven asset. The US Federal Reserve’s measured pace in reducing interest rates through 2024 kept its benchmark rate near 5.25%, prompting currency and capital flow volatility in emerging markets. India, too, felt the tremors. Despite the Reserve Bank of India keeping the policy repo rate steady at 6.5% throughout FY2024–25, the rupee depreciated from ₹81.85 to ₹83.45 per dollar—a near 2% drop.

READ I Delhi’s urban crisis: Pollution, health gaps, inclusion

Gold price outlook

This depreciation magnified domestic gold prices, given that global gold is dollar-denominated. As RBI data show, global uncertainty, coupled with a weakening rupee, has kept gold buoyant in local markets. The trajectory suggests that India’s gold price will remain sensitive to external shocks—both geopolitical and monetary.

Citi’s recent analysis highlights a growing risk that gold may have already peaked in its current rally, with prices likely to soften in late 2025 and early 2026. While Citi still projects near-term consolidation between $3,100 and $3,500 per ounce in the third quarter of 2025, the bank warns that investment demand is fading and global growth conditions are improving—factors which could push prices below $3,000 and ultimately back down to $2,500–$2,700 by the second half of 2026

Strategic diversification of reserves

Central banks worldwide are reassessing their reserve compositions, diversifying away from over-reliance on the dollar. India has followed suit. According to the World Gold Council, the RBI added 19.2 tonnes of gold to its reserves in 2023, taking total holdings to 812 tonnes—up from 760 tonnes in 2021. Gold now accounts for around 8% of India’s foreign exchange reserves.

This accumulation serves multiple functions: insulating the economy from currency volatility, building global market confidence, and aligning with the reserve strategies of other BRICS economies. For India, gold is no longer just an inert asset; it has become a statement of financial prudence and strategic autonomy.

Industrial and technological demand

While jewellery and investment continue to dominate India’s gold consumption, industrial demand is no longer negligible. Globally, the technology sector consumed 326 tonnes of gold in 2023—a 7% increase year-on-year. In India, industrial uptake is expanding in semiconductors, precision connectors, and sensor applications, aided by government incentives for electronics and chip manufacturing.

Gold’s role in clean technologies is also growing. With India ramping up solar power capacity and exploring green hydrogen, gold is being used in photovoltaic cells and electro-catalytic processes. These emerging industrial uses could provide a long-term base for domestic demand, making gold more than a cyclical asset.

Digital transformation of gold investment

Perhaps the most visible transformation lies in how Indians are buying gold. Fintech platforms such as PhonePe, Paytm, and MMTC-PAMP have popularised digital gold—offering micro-investments as low as ₹10, backed by physical gold stored in vaults. This has enabled broader participation, particularly among younger, urban investors.

A 2023 report by the India Bullion and Jewellers Association and KPMG noted a 43% year-on-year rise in digital gold investment, driven by millennials and Gen Z Sovereign Gold Bonds (SGBs) have also gained popularity. Offering an annual interest of 2.5% in addition to capital appreciation, SGBs saw subscriptions worth ₹7,000 crore in FY2023–24.

Together, these instruments represent a modernisation of gold investment, reducing friction costs, improving transparency, and helping formalise what was once a largely informal market.

Gold price volatility and investor outlook

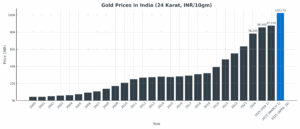

On Akshaya Tritiya in April 2025, gold prices hit a record ₹98,592 per 10 grams—a doubling over five years. Brokerages such as ICICI Securities and Kotak Mahindra Bank expect prices to breach ₹1,00,000 per 10 grams later in 2025, driven by inflation fears and geopolitical instability.

But the road ahead may not be linear. India Ratings and Research, part of the Fitch Group, warns of a possible correction if global conditions improve. A sudden dollar resurgence, easing geopolitical risk, or a shift in global liquidity could deflate the current rally. The gold market, like all financial markets, is as vulnerable to reversal as it is to momentum.

India’s relationship with gold is being recast in modern economic terms. Once a static store of value, it is now a dynamic tool of monetary policy, industrial expansion, and digital innovation. Its importance will depend not just on tradition or sentiment, but on the country’s ability to integrate gold into its broader economic strategy—whether through reserve diversification, clean technology, or formal financial instruments.

In the coming years, the forces that will shape gold’s trajectory in India include the RBI’s reserve strategy, global central bank decisions, tech-sector demand, and the evolving preferences of Indian retail investors. Regardless of whether prices climb further or stabilise, one fact remains: gold is no longer merely a safe haven. It is a central node in India’s evolving economic architecture.

Naman Mishra is a doctoral researcher, and Palakh Jain is Associate Professor at Bennett University, Greater Noida.